Jan 8, 2024

Budgeting for Young Adults: 19 Money Saving Tips for 2024

From juggling student loan payments to saving for a car, making personal finance decisions can be overwhelming. On top of that, you may have other financial goals in mind but no idea how to achieve them.

To help get your finances on track and prepare for your future, you may want to start a budget.

Budgeting is the process of creating a plan for how you’ll spend and save your money to help achieve your goals.

To help you on your financial journey, we’ve gathered the following tips that can help with budgeting for young adults:

- Track your spending

- Prioritize paying off debt

- Set short and long-term goals

- Create a detailed plan

- Try a zero-sum budget

- Start an emergency fund

- Take advantage of employer matching

- Practice frugal habits

- Follow the 50/30/20 budget

- Save for retirement

- Use a bullet journal

- Talk to a professional

- Keep taxes in mind

- Try a side-hustle

- Use personal finance apps

- Protect your health

- Negotiate your salary

- Try the envelope method

- Automate your savings

Ready to start budgeting? Let’s get started with these 19 financial tips!

1. Track your spending

Before you can get started on your young adult budget, you must first understand where your money is going. You can do this in many ways, whether by keeping track of your receipts, using an app, or setting up a spreadsheet.

When tracking your spending, it can be helpful to categorize your transactions to help get a sense of what you’re spending your hard earned money on. These categories may include rent, groceries, utilities, clothing, entertainment, and more.

Remember, there is no set group of categories you should follow, so be sure to categorize your spending however works best for you and your shopping habits. Once you get a big-picture sense of your spending, you can better organize a budget that makes sense for you.

2. Prioritize paying off debt

When looking to improve your future spending, it’s crucial that you don’t forget about any debt you may have. From student loans to credit card debt, prioritizing getting out of debt can help you get out from under any interest payments that are getting in the way of your financial goals.

You can prioritize paying off your debt in different ways, including:

- Snowball method: You can follow the snowball method by paying off your debts, starting with the smallest amounts and working your way up to the largest. This works well for people with small debts, typically less than $3,000.

- Avalanche method: With the avalanche method, you’ll prioritize paying off your debts by starting with the highest interest rates and working your way down to the debts with the lowest interest rates. That way, you’re limiting the time spent holding on to debt with high-interest rates and your overall interest expense.

Whether you decide to use the snowball or avalanche method, continue making the minimum monthly payments on all of your debts as you focus your extra money on paying off the highest-priority debts.

3. Set short and long-term goals

Setting short and long-term goals is a great way to boost your financial success. That way, you can always keep your eyes on the prize. Start a practice of writing down your goals, this will help keep them top of mind for you when you’re making daily spending decisions.

These goals should be customized based on your specific wants and needs. For example, a short-term goal may be to pay off all of your student loans within three years and a long-term goal might be to retire by age 60.

4. Create a detailed plan

A financial plan is a way to assess your current financial situation, identify long-term financial goals, and create a road map to achieve them.

No matter your financial situation or goals, creating a detailed financial plan for young adults is a surefire way to keep yourself committed to financial success. A budget and a financial plan may sound very similar. A budget is a tool for tracking and managing your spending and savings on a short-term basis, where a financial plan actually maps out your goals over the long-term and your plan to achieve them. You can keep it simple and do this using a pen and paper, or you can utilize spreadsheets, templates, budgeting apps, or whatever works best for you.

5. Try a zero-sum budget

Now that you have a sense of how to start a budget, you may wonder what type of budget you should follow. A popular option for young adults is the zero-sum budget. The zero-sum budget is a budgeting method in which you use every penny of your income every single month.

But don’t get your hopes up, as it doesn’t mean you get to blow all of your money on flashy purchases and summer vacations. Instead, you’ll allocate your monthly income towards your wants and needs, debt payments, and savings goals until every penny of your income is accounted for.

For example, let’s say you have a monthly income of $4,167. With the zero-sum method, your budget may look like this:

| Monthly expenses | Cost |

|---|---|

| Rent | $1,400 |

| Groceries | $500 |

| Bills | $350 |

| Insurance | $200 |

| Entertainment | $250 |

| Emergency fund | $400 |

| Credit card payments | $400 |

| Student loan payments | $300 |

| Retirement savings | $367 |

| Total spending | $4,167 |

As you can see, by combining your spending and saving, you’re using up all of your monthly income while also meeting your savings and debt payment goals.

6. Start an emergency fund

Let’s face it. Life can get in the way sometimes. Whether it’s unexpected job loss, car damage, or any other financial emergency, there are times when we could all use some extra cash. Fortunately, you can help dampen the financial burden of these situations by starting an emergency fund with your first budget.

Generally speaking, you’ll want your emergency fund to cover around 3-6 months of expenses. By building up an emergency fund, you can live your life in comfort, knowing you’re prepared to handle any unexpected circumstances that could impact your financial well-being.

7. Take advantage of employer matching

If you’re fortunate enough to work for a company that offers retirement plans with employer matching contributions, it can benefit your financial future to take advantage of it.

For example, if your salary is $50,000 and your company offers 6% matching with their 401(K) plan, your employer will match your contribution up to $250 each month. This means if you decide to contribute $250 a month towards your 401(K), your employer will also contribute $250 bringing the total monthly contribution into your 401(K) to $500.

By taking advantage of this benefit, you can increase the amount of money that goes towards your retirement every month, allowing you to build up your retirement savings and accumulate wealth more quickly.

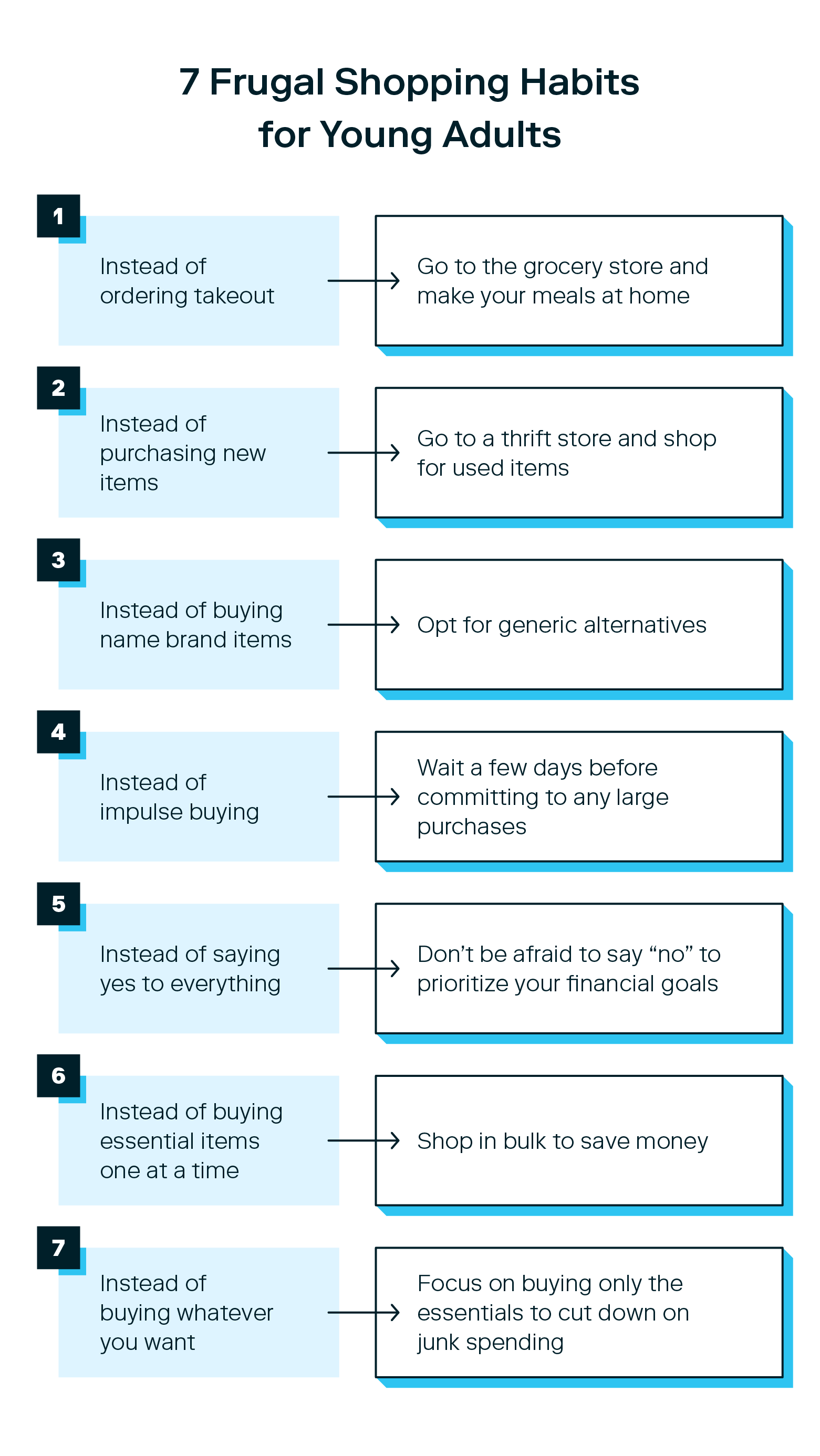

8. Practice frugal habits

When prioritizing budgeting for young adults, adopt smart spending habits to avoid spending unnecessary money. Examples of these frugal habits include:

- Making meals at home: By prioritizing groceries over eating out at spendy restaurants, you can limit the money you spend on food every month.

- Shopping secondhand: Whether you buy a used car or furnish your home with used furniture, shopping secondhand can help you reduce spending.

- Skipping brand name items: Generic brands are usually much cheaper than their brand-name counterparts. By shopping for generic brands, you can cut costs at the register.

- Waiting before you buy: If you’re prone to impulse spending, try forcing yourself to wait a few days before making any big purchases. Often, waiting it out can help you realize if your desired purchase is truly necessary.

- Learning to say “no”: In some cases, you may get invited to do things that go against your financial goals. By learning to say “no,” you can avoid committing to things that may be beyond your financial means.

- Buying in bulk: From toilet paper to canned goods, buying in bulk can sometimes come with huge savings, keeping you from paying more than you have to for your essential items.

- Buying essential items only: By sticking to only the essentials every time you shop, you can avoid throwing money away on unnecessary junk spending. Creating a list before you go shopping can help you stick to the task at hand and not get distracted by what you see.

While nobody goes from a mindless spender to a frugal shopping wizard overnight, keeping these frugal habits in mind can help you spend less on your shopping outings.

9. Follow the 50/30/20 budget

Another popular budget for young adults is the 50/30/20 budget. Under the 50/30/20 rule, you’ll split up your monthly income as follows:

- 50% for essentials

- 30% for wants

- 20% for savings

For example, if you make $4,167 a month, you’ll dedicate $2,083.50 to essentials, $1,250.10 to wants, and $833.40 to savings.

By sticking to this simple rule, you can easily budget your spending without skipping out on fun purchases and experiences, all while satisfying your monthly savings goals.

10. Save for retirement

As a young adult, meeting your retirement goals can seem like a far-fetched idea or tomorrow’s problem. But the reality is there is no better time to start saving for retirement, as the earlier you start, the quicker you’ll be able to retire.

This is especially true due to compound interest. In simple terms, you can think of compound interest as “interest on your interest,” meaning the quicker you save money for retirement, the more time it has to grow.

Let’s say you begin saving $150 a month with an average positive return of 1% a month, compounded monthly over 30 years. After those 30 years, your retirement savings will be nearly $525,000.

On the other hand, let’s say you waited 30 years and instead invested $1,200 a month for ten years with the same average positive monthly return. Despite your increased monthly contribution, your retirement savings would only be around $275,000.

As you can see, time is your friend when saving for retirement. Keep in mind that many compound interest accounts require a minimum deposit to get started. Because of this, be sure to do your research and select an account that works best for your financial situation.

11. Use a bullet journal

Another popular way to create budgets for young adults is to use a bullet journal. A bullet journal is highly customizable and includes specific sections you can use to organize your spending, goals, time, and other aspects of your life.

Because there is no right or wrong way to use a bullet journal, you can organize your pages however you’d like. This is a helpful method for those who prefer to physically write things down rather than using a digital method such as a spreadsheet.

12. Talk to a professional

A lot of the time, people may wait until they have a lot of money or are in a crisis before seeking help from a financial advisor. But that doesn’t have to be the case with you.

By being proactive and going over your finances with a professional, you can help come up with a plan tailored to your income, expenses, and financial goals. Plus, it doesn’t hurt to have someone who can answer all of your questions and help you create a personalized budget based on the advice of an expert.

13. Keep taxes in mind

Whenever you’re thinking about budgeting and financial planning, you’ll want to keep your taxes in mind. After all, the amount of money listed for your salary isn’t the same amount that will reach your bank account. Because of this, always use your monthly income after taxes when planning your budget.

In addition, you’ll want to do your research and see if you’re eligible for any tax deductions that can put money back into your pocket. Examples of common tax deductions include deductions for student loan interest and charitable donations.

If you’re unsure what deductions you qualify for, you may want to talk to a tax professional.

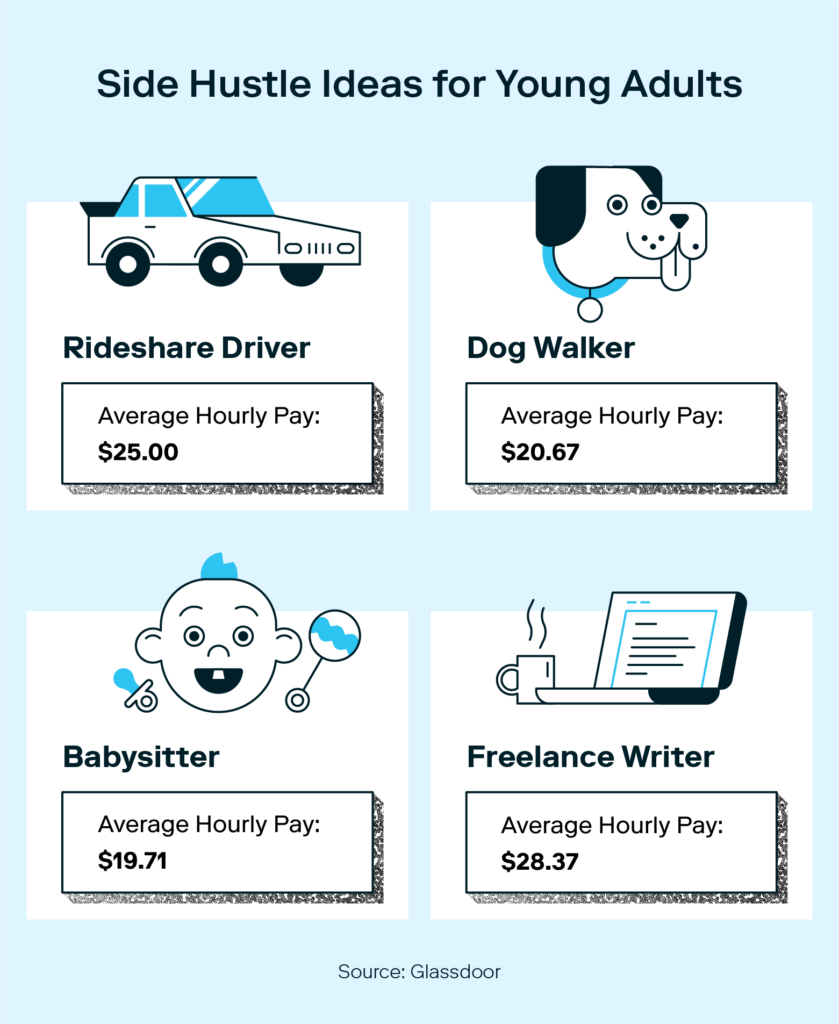

14. Try a side-hustle

If you’re looking to turn your free time into some extra cash, you may want to take up a side hustle. Side hustles can vary, from picking up an extra job to turning one of your unique skills or talents into a source of income. Need some side hustle inspiration? Try one of these ideas:

- Become a rideshare driver (Average hourly pay: $21.41)

- Tutor your favorite subject (Average hourly pay: $18.33)

- Sell your talents as a freelance writer (Average hourly pay: $24.26)

- Start babysitting (Average hourly pay: $16.22)

- Become a dog walker (Average hourly pay: $17.54)

No matter your interests or talents, there are many paths to bring in some extra income. If time is a limiting factor, consider passive income sources.

15. Use personal finance apps

For those interested in using technology to help with budgeting ideas for young adults, there are numerous personal finance apps you can use to take control of your finances.

From tracking your spending with a budgeting app to practicing long-term investing with an investing app like Stash, your phone can be a valuable tool for staying on top of your financial goals.

Not only that, but personal finance apps are a great way to manage your budget and finances wherever you go, with some apps even offering the option to link your debit or credit cards to give you an up-to-date view of your monthly spending.

16. Protect your health

Even if your goal is to save as much money as possible, you shouldn’t write off medical insurance as an unnecessary expense. Accidents happen, no matter how careful you are, and medical insurance can be the difference between small out-of-pocket costs and life-changing medical bills.

Something as minor as an accidental sports injury could end up costing you thousands of dollars if you’re uninsured and could put a massive roadblock in between you and your financial goals. Because of this, research what medical insurance is best for you. In some cases, it may be offered through your employer.

17. Negotiate your salary

On top of prioritizing saving money to improve your financial well-being, you can also work towards increasing your monthly income by negotiating your salary. When negotiating your salary, you should first determine your fair market value by assessing the salary of similar job postings.

Then, you’ll want to bring evidence of your value to the company to help show your boss why you deserve a raise. From there, be prepared to answer any questions your boss may have. While this isn’t guaranteed to work every time, you may be able to earn an increased wage which can help you achieve your financial goals.

18. Try the envelope method

Another popular budgeting method for young adults is the envelope method. The envelope method is a budgeting system used to help control where your money goes.

With the envelope method, you’ll want to dedicate an envelope to each spending of your spending categories. For example, if you allow yourself $500 a month for groceries, you’ll want to cash your paycheck and then put $500 into your grocery envelope.

Then, when it’s time to go grocery shopping, you’ll take the $500 and start shopping. Once you’re finished, you’ll put the change back into the envelope, so it’s ready for next time. Once you run out of money, you’re done buying groceries for the month.

This method is a great way to keep yourself from overspending, as you’ll have a physical sense of the money that is leaving your hands with each purchase.

19. Automate your savings

Another great way to help with your budgeting is to automate your savings. Depending on your checking or savings account, you may be able to set up automatic transfers every month. An example of this would be an automatic monthly transfer of $100 into your savings account or emergency fund. Another method to automate savings is to split your paycheck into two different accounts each payroll period, this way a portion of your money goes directly into a savings account where it is out of sight and out of mind.

That way, you can rest easy knowing that your savings goals are being met without you even having to lift a finger, allowing you to focus on other aspects of your financial health, like saving money or earning extra income.

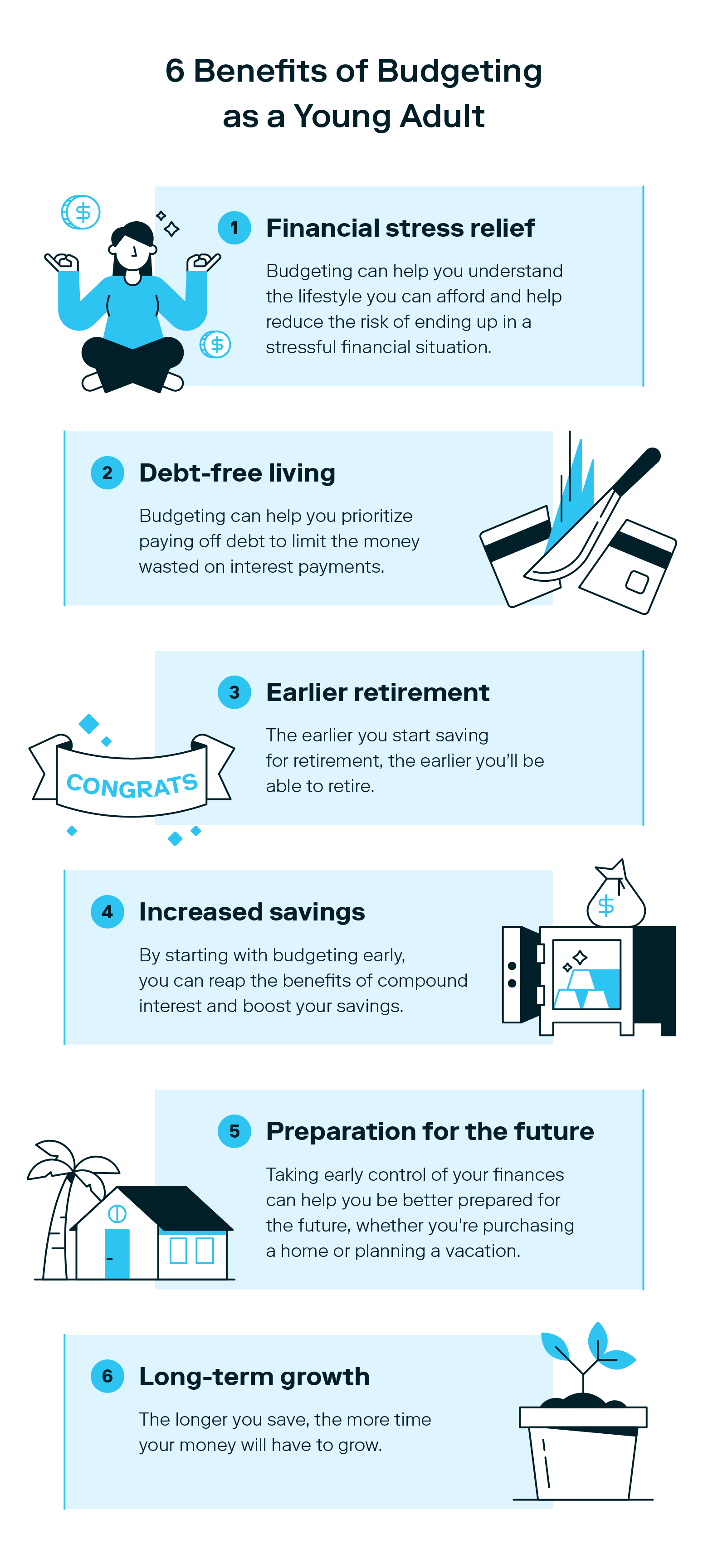

Why you should start budgeting as a young adult

As a young adult, you may feel that budgeting is something that can wait. But by putting off prioritizing your financial health, you’ll be missing out on a wide range of benefits, including:

- Financial stress relief: Taking the time to plan your finances and set spending limits can help you get a birds-eye view of your finances so you have a better understanding of what you can afford. This can help prevent the money stress that can come from poor money management.

- Debt-free living: A large benefit of budgeting is that it allows you to allocate specific amounts of money to help pay off your debts. By prioritizing debt payments early in your life, you can limit the money wasted on interest payments.

- Earlier retirement: When it comes to retirement, the earlier you start saving, the earlier you can retire. Because of this, taking control of your spending at a young age can help maximize your retirement savings.

- Increased savings: By automating your savings and starting an emergency fund during your budgeting process, you can increase your overall savings.

- Preparation for the future: Similar to planning for retirement, setting a budget can help you be better prepared for the future, whether you’d like to purchase a home or go on an international vacation.

- Long-term growth: If you start taking your finances seriously at a young age, you can reap the benefits of time, leading to increased growth compared to starting years down the line.

When it comes to budgeting for young adults, remember that the earlier you start, the better. Whether you’d like to quickly get out of debt or take the money you’ve saved to grow your wealth with long-term investing, focusing on budgeting is a great first step to getting your finances in check.

Investing made easy.

Start today with any dollar amount.

Budgeting for young adults FAQs

Still have more questions about budgeting advice for young adults? We’ve got answers.

How do you keep track of a budget?

You can keep track of a budget in many ways, including using a pen and paper, spreadsheets, budgeting templates, a bullet journal, or budgeting apps.

Is the 50/30/20 rule realistic?

While the 50/30/20 rule can be a realistic option for some, it may not work for everyone’s specific financial situation. Because of this, prioritize following a budgeting plan that works best for you and your financial goals.

What is the 70% rule for budgeting?

The 70% rule for budgeting is when you allocate your money as follows:

- 70% for all spending

- 20% for saving and investing

- 10% for debt payments

Related Articles

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024

What Is a Financial Plan? A Beginner’s Guide to Financial Planning

How to Save Money: 45 Best Ways to Grow Your Savings

Exploring the 50/30/20 Rule: A Simple Budgeting Strategy