Jan 3, 2024

What Is a Financial Plan? A Beginner’s Guide to Financial Planning

| What Is the Purpose of a Financial Plan? Financial planning comes down to a few key things: knowing where you stand financially, identifying your financial goals, and building a plan to reach those goals. |

A financial plan is a way to assess your current financial situation, identify long-term financial goals, and create a road map to achieve them. A good financial plan not only considers your current finances—including your cash flow, budget, debt, and savings—but also your long-term financial goals like saving for retirement.

In this post, we’ll break down the necessary steps to create a financial plan, including:

- 1. Find your net worth

- 2. Examine your cash flow

- 3. Identify your financial goals

- 4. Build an emergency fund

- 5. Contribute to an employer-sponsored retirement plan

- 6. Pay down high-interest debt

- 7. Invest to build wealth

- 8. Periodically review and adjust your financial plan

Dive into a more thorough breakdown below as we help answer the question: what is a financial plan?

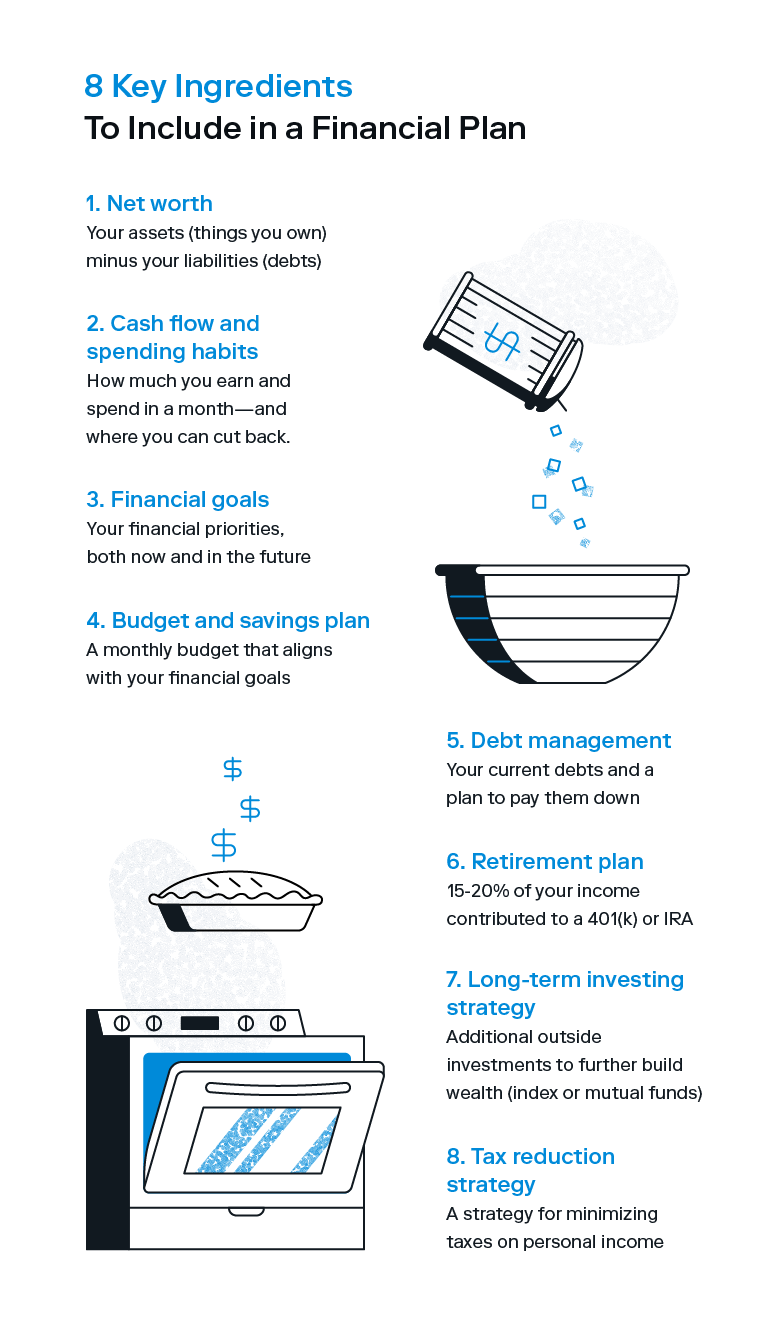

8 essential financial planning components

Financial planning is like a road map to help you meet both your short-term needs and long-term goals. While every financial plan is different, they typically include the following:

- Your net worth: your assets (things you own) minus your liabilities (debts)

- Cash flow and spending analysis: your flow of money coming in and out each month (or year) and analysis of spending patterns

- Financial goals and priorities: your financial goals, both big and small, short term and long term

- Budget and savings plan: your current cash flow and financial goals can guide how you set up your monthly budget

- Debt management: any debts you currently have and a plan to pay them down.

- Retirement plan: a plan for saving a portion of your income (15–20%) for retirement, ideally in an employer-sponsored retirement account like a 401(k) or IRA

- Long-term investing: additional outside investments to further build wealth, such as index or mutual funds

- Tax reduction strategy: a strategy for minimizing taxes on personal income

Remember, there’s no template for the perfect financial plan—it should be customized to fit your unique circumstances and priorities. Review each financial plan component and adjust as necessary.

Ready to feel more financially confident?

Checkout Stash’s 2024 financial checklist.

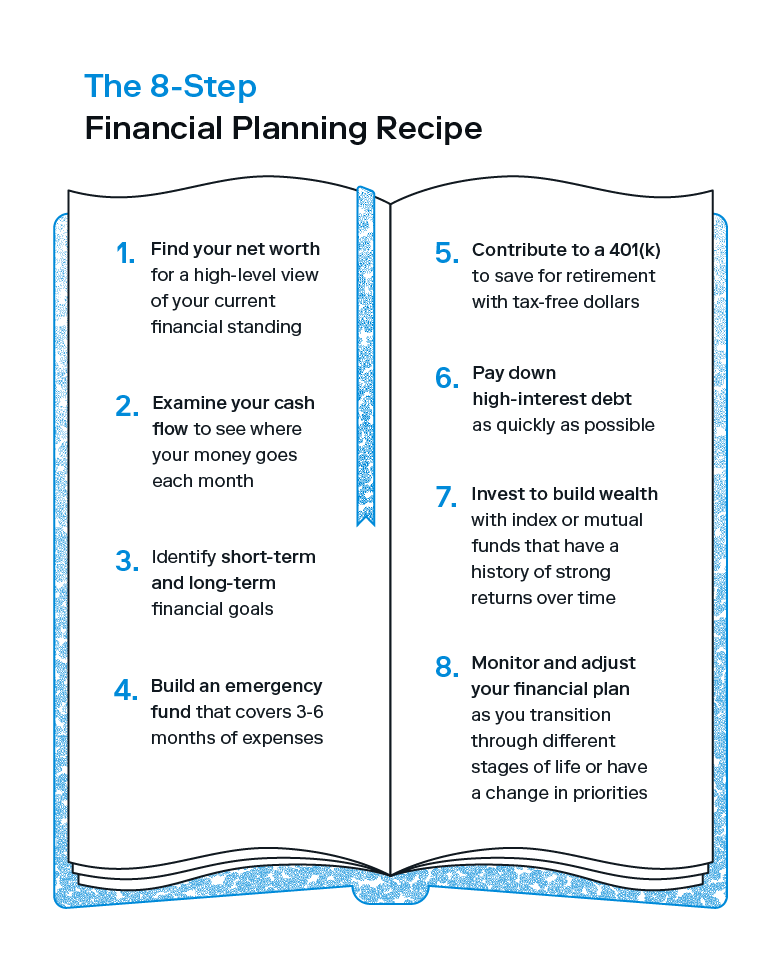

How to create a financial plan in 8 steps

Personal financial planning is an ongoing process and should be highly unique to your needs. That said, addressing the following steps can help you create a well-rounded plan.

1. Find your net worth

Find your net worth by assessing your current assets and liabilities. Assets are anything of value that you own, like a home, car, cash savings, or investments. Liabilities include anything you owe money on, like credit card debt, student loans, car loans, or mortgages.

To find your net worth, subtract your total liabilities from your total assets. This gives you a clearer picture of your current financial health.

2. Examine your cash flow

A financial plan can’t exist without first knowing where your money is going each month. Review how much you earn and spend to determine how much you could reasonably save and invest on a monthly basis—or where you could cut back to save and invest more.

Start by documenting your mandatory monthly expenses like rent or mortgage payments, home or car insurance, bills, and utilities. Then, factor in other costs like food and groceries, transportation, and subscriptions before moving onto additional spending categories like clothes, travel, and entertainment. Subtract your expenses from your income to see what’s leftover.

This should give you a better idea of exactly where your money is going each month. From here, you can assess if your current spending aligns with the financial goals you’ll outline in the next step.

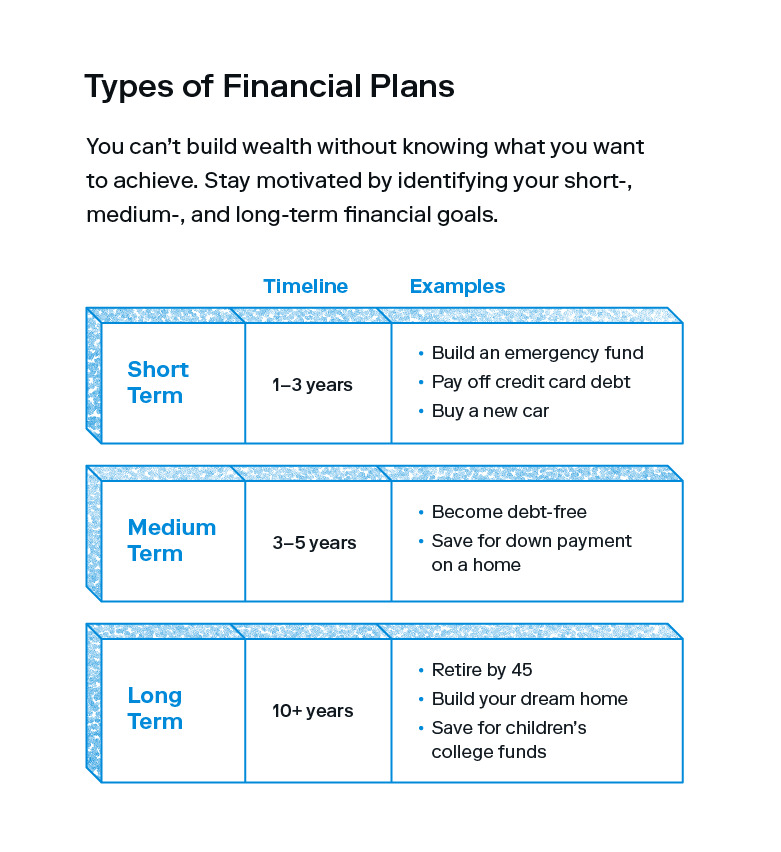

3. Identify your financial goals

You can’t make a financial plan without first knowing what your financial goals are. Your financial goals are simply the things you hope to accomplish with your money, both short term and long term. Ultimately, it means considering what you want in life and how you can put your money to work to get there. On a high level, consider the following:

- What do I want to achieve?

- What’s most important to me?

- What type of lifestyle do I want to lead?

Use these questions to make a list of goals, and break them down by short term, medium term, and long term:

- Short-term financial goals can be achieved in one to three years (i.e., building an emergency fund).

- Medium-term financial goals can be achieved in 3-5 years (i.e., saving for a down payment on a home).

- Long-term financial goals can be achieved in 10+ years (i.e., retiring by 45).

Are you hoping to pay off debt or build an emergency fund? Those are examples of short-term goals. Long-term goals could include saving for retirement, saving for your future children’s college funds, or building a dream home in a new city.

Determine how much each goal will cost and the time frame for when you hope to achieve it. The more specific your goals are, the easier it will be to take action on them.

| Investor tip: Once you know your goals, find out how much you need to save for each one and adjust your budget accordingly. |

4. Build an emergency fund

If you don’t already have an emergency fund, prioritize building one. Ideally, it should be enough to cover three to six months of living expenses, but if you can’t afford that yet, you can start small and add more over time. Stashing away even just $1,000 can help cover any small emergencies, sudden medical procedures, or unexpected repairs. You can incrementally add more to your fund over time.

| Investor tip: If you have high-interest credit card debt, prioritize more of your budget toward paying this off first. A smaller emergency fund of $1,000 (or one month of expenses) is acceptable while paying off credit card debt or other debts with interest rates above 10%. |

5. Contribute to an employer-sponsored retirement plan

If it’s available to you, the next step is to ensure you’re contributing to an employer-sponsored retirement plan like a 401(k)—especially if your employer offers a matching contribution. If they do, prioritize contributing at least the minimum amount needed to get the match, as that match is essentially free money.

Even if you have high-interest debt, you should still prioritize contributing to an employer-sponsored retirement account (at least the minimum amount to get the match). The reason is because employer matching funds are tax-free, risk-free, guaranteed returns—often at a higher rate than your debts.

6. Pay down high-interest debt

Once you’re taking advantage of your employer match, you should make a plan for tackling any debt. Prioritize high-interest debt first, as you could be paying double or triple what you actually owe due to high interest rates. In any case, a good starting point is to make the minimum monthly payments on all of your debts.

There are a variety of approaches to paying off debt, from increasing your monthly credit card payments, getting a debt consolidation loan, or using the snowball method or avalanche method. Choose the approach that works best for you, but remember to pay off the most demanding debt first. Ultimately, the goal is to become debt-free as soon as possible, so figure out how much you can feasibly allocate toward debts each month and get started.

7. Invest to build wealth

Make a plan to invest in the stock market based on your financial goals and risk tolerance. Regardless of your specific long-term financial goals, planning to have enough income in retirement is key to any well-rounded financial plan.

This could include various savings accounts and retirement accounts like 401(k)s and individual retirement accounts (IRAs), which are a good starting point for your retirement savings. From there, you can add other accounts to fit your goals. While there are countless ways to invest, ETFs or mutual funds make excellent long-term investments due to their stable growth over time.

Rather than putting all your eggs in one basket by investing in a single stock, ETFs or mutual funds contain shares of hundreds of different companies within a single fund, instantly diversifying your portfolio. This makes them a great choice for new investors who don’t have the time or experience to analyze individual stocks but want a reliable way to invest for the long term. A diversified portfolio will help you grow your investments steadily over time.

| Investor tip: If you’re ready to start investing but don’t have a large amount of capital upfront, creating a brokerage account with a robo-advisor is a low-cost way to get started. Investing is a marathon, not a sprint—a small amount now is better than nothing! |

8. Periodically review and adjust your financial plan

Regularly check in on your financial plan to track your progress toward goals and make any adjustments. This may include altering timelines for certain goals, setting higher savings minimums, or increasing your investments or rebalancing your portfolio.

You might find that you don’t have the same priorities five years down the road, and life is full of unexpected circumstances that can impact your plan. Stay flexible and expect to revise your plan based on your unique experiences.

Here are some check-in questions to consider (or questions to regularly ask a financial advisor):

- How is my current portfolio working toward my goals?

- What major life events are approaching (if any) that I should plan for (starting a family, moving cities, starting a business, etc.)?

- Are my current spending and saving habits serving the lifestyle I want to live?

- How do I feel about my current budget?

- Are there any upcoming big purchases (over $500) that I should be aware of?

- What is my top spending category? Does this feel aligned with what I value?

- Can I increase my automated savings/investments?

Committing to annual check-ins ensures your financial plan remains aligned with your goals.

Additional financial planning considerations

The steps above will position you for financial success early on.

Once you’ve made progress with your initial goals and investments, consider these additional financial plan components:

- Risk management planning: you may already have home or car insurance, but don’t forget about life and disability insurance, personal liability coverage, and property coverage to further protect you in the event of unexpected emergencies.

- Tax reduction planning: once your investments are set, you can move on to more advanced goals like creating a tax reduction strategy to minimize taxes on personal income.

- Estate planning: having a plan for who will inherit your estate (your possessions and valuables) might seem irrelevant if you’re young, but you’ll eventually need to consider this important financial plan component. This ties into your generational wealth goals that will directly impact your family and loved ones, including your will.

Remember, the only asset more valuable than money is time. The steps above are key to protecting all the hard work you’ll put into the rest of your financial plan. If you’re feeling overwhelmed at the thought of navigating a financial plan on your own, a financial advisor can be an incredible resource.

Eventually, you may consider eliciting some outside help from any of the following types of financial advisors:

- Traditional financial advisor: a financial advisor can help with all aspects of your financial life, including saving, investing, insurance, and other forms of planning. If you have a complicated financial situation, they also offer specialized services like tax preparation and reduction or estate planning.

- Online financial planning services: instead of visiting a financial planner in person, you can access the same services virtually. Most offer the same services as a traditional advisor, such as investment management and helping you build a financial plan.

- Robo-advisor: if you’re only looking for help managing or building your investment portfolio, a robo-advisor can help—and at a low cost. A robo-advisor automatically builds your portfolio based on your investment preferences, and manages it on your behalf. Robo-advisors can be a less expensive, more accessible avenue for investors who don’t want to cover the cost of a personal financial advisor.

If you choose to go with a traditional financial advisor, we recommend fee-only advisors who are fiduciaries—meaning they’re legally obligated to act in your best interests. When looking for a financial advisor, be sure to find one who cares about your big picture: paying off debt, having emergency savings, covering tax bases, and building wealth for the long term.

At the end of your financial plan, you’ll have a strong understanding of where you are financially, where you want to be, and how you’ll get there. While finances as a whole can be complicated, the financial plan components are quite simple—and once you get started, you’ll feel more empowered to build the financial life you deserve. Successful wealth building doesn’t happen overnight, but planning for the long-term will pay off in big ways down the road.

Investing made easy.

Start today with any dollar amount.

FAQs about financial planning

Find answers to any lingering questions about financial planning below.

What is the purpose of a financial plan?

A financial plan is a road map for putting your money to work in a way that serves the life you want to lead, both now and in the future. Achieving short-term and long-term goals, gaining control over your finances, and ensuring financial security during retirement are all key purposes of a financial plan.

Why is financial planning important?

Financial planning is more than just accumulating wealth—it’s about using that wealth intentionally in a way that supports your core values and dreams in life. When you have a financial plan, you’re more likely to put your money toward only the things that serve your highest goals. Financial planning also helps reduce stress about money.

What are the types of financial planning?

There are a variety of types of financial planning, including cash flow planning (your monthly income and expenses), investment planning (using index or mutual funds to achieve long-term wealth goals), insurance planning (prioritizing health and life insurance), and tax planning (strategically minimizing income taxes).

Related Articles

The 2024 Financial Checklist: A Guide to a Confident New Year

9 Ways to Celebrate Financial Wellness Month

Budgeting for Young Adults: 19 Money Saving Tips for 2024

The Best Personal Finance Books on Money Skills, Investing, and Creating Your Best Life for 2024

How to Save Money: 45 Best Ways to Grow Your Savings

Exploring the 50/30/20 Rule: A Simple Budgeting Strategy