Jan 31, 2023

How Much Should I Be Investing? A 2023 Breakdown by Income Bracket

How much should I be investing?

Generally, experts recommend investing around 15% of your income. But the more realistic answer might be whatever amount you can afford.

If you’re wondering, “how much should I be investing this year?”, the answer is to invest whatever amount you can afford! Still, the general rule of thumb is to strive to invest 10%-20% of your income regularly into individual retirement accounts (IRAs) and other investment portfolios.

And since there’s an abundance of investment options to choose from, it’s best to identify just how much you should be investing before diving. To that end, follow our 3-step investing guide featuring a cost breakdown by income bracket and expert tips.

How much should you invest? It mainly depends on your income.

The exact number of how much to invest depends on your current financial situation and your net income level. Calculate your net income (after expenses) and see if it’s feasible to consistently invest 10%-20% of that amount. For reference, here’s how that might shake out across different income levels:

| Income | 10% | 15% | 20% |

|---|---|---|---|

| $25,000 | $2,500 | $3,750 | $5,000 |

| $35,000 | $3,500 | $5,250 | $7,000 |

| $45,000 | $4,500 | $6,750 | $9,000 |

| $55,000 | $5,500 | $8,250 | $11,000 |

| $65,000 | $6,500 | $9,750 | $13,000 |

| $75,000 | $7,500 | $11,250 | $15,000 |

| $85,000 | $8,500 | $12,750 | $17,000 |

| $95,000 | $9,500 | $14,250 | $19,000 |

| $125,000 | $12,500 | $18,750 | $25,000 |

Experts also recommend that financially literate investors factor their contributions into their expected expenses and never invest more than they are willing to lose.

3 steps to determine how much you should be investing

So, how much of your income should you invest? Once more, that’s ultimately up to your risk profile and lifestyle. Still, you can follow these three steps to help assess what number is in your comfort zone.

1. Understand your current financial situation

Having a firm grasp on your personal finances will help you understand how much of your income you should invest.

The following factors of your financial profile must be addressed before accruing investments:

- Taxed income: record the most recent taxed income from your latest Form W2. This will be the basis of your financial plan.

- Debt (if any): if you still have debt, it’s time to strategize a

payment plan. Without debt, you’ll have more disposable income to invest. - Emergency funds: save enough money to cover around three to six months’ worth of basic living expenses.

- Rainy day funds: save enough money to cover major financial events like an unexpected medical bill or your car breaking down.

Before adding funds into an investment account, you should prioritize paying off your debt and credit card balances.

After you pay off any remaining debt and create savings funds, subtract your living expenses from your taxed income. Any remaining money is what you can potentially begin to invest with.

If you liquify assets frequently due to being short on cash or in debt, you risk lowering or losing your ROI (return on investment) and prolonging the time it takes to achieve your investment goals.

The key to achieving a healthy long-term investing strategy is setting attainable investment goals aimed at building a diverse portfolio of assets.

2. Set attainable investment goals

Before exploring the different types of investments and their associated costs, ask yourself the following questions to determine why you’re investing in the first place:

- What motivates your investment strategy? Think about why you want to start investing. Knowing your end goal can help narrow down which investing platforms and tools you’ll use.

- Is there an amount of money you hope to earn from investing? if you are saving for retirement, for example, then calculate the figure you’re interested in reaching by the time you are ready to retire.

- What is your investment timeline? consider when you would like to reach your investment goal. Understanding your timeline will help you decide which assets are the best fit for your schedule.

- What is your risk tolerance? every asset type has a different level of associated risks. Market volatility plays a big role in the health of an investment market so carefully consider which asset classes you want to add to your investment portfolio.

- Do you want to actively or passively invest? active investment examples can include day trading with stock market assets. Passive investing enables investors to take a hands-off approach to their investing strategy by funding accounts that don’t require a consistent effort to maintain.

Now that you have a firm grasp of your financial situation and what motivates your investments, it’s time to start setting attainable goals. Here are a few investment goals to consider:

- Buying a home: money earned from an investment account can help you pay for the down payment of a new home or supplement the mortgage cost.

- Having a child: it’s never too early to begin saving for your child’s future. You can start a college investment fund or simply save for another mouth to feed.

- Retiring: the sooner you start saving for retirement, the more time you have to add to your retirement nest egg.

- Earning passive income: simply adding funds into an investment account can potentially earn you passive income every year.

- Living comfortably: investment income can enhance your lifestyle or allow for high-quality experiences, like regular travel or a car upgrade.

Answering these questions and setting attainable investment goals will help you understand what is realistic when formulating long-term investing strategies.

3. Create a realistic spending plan

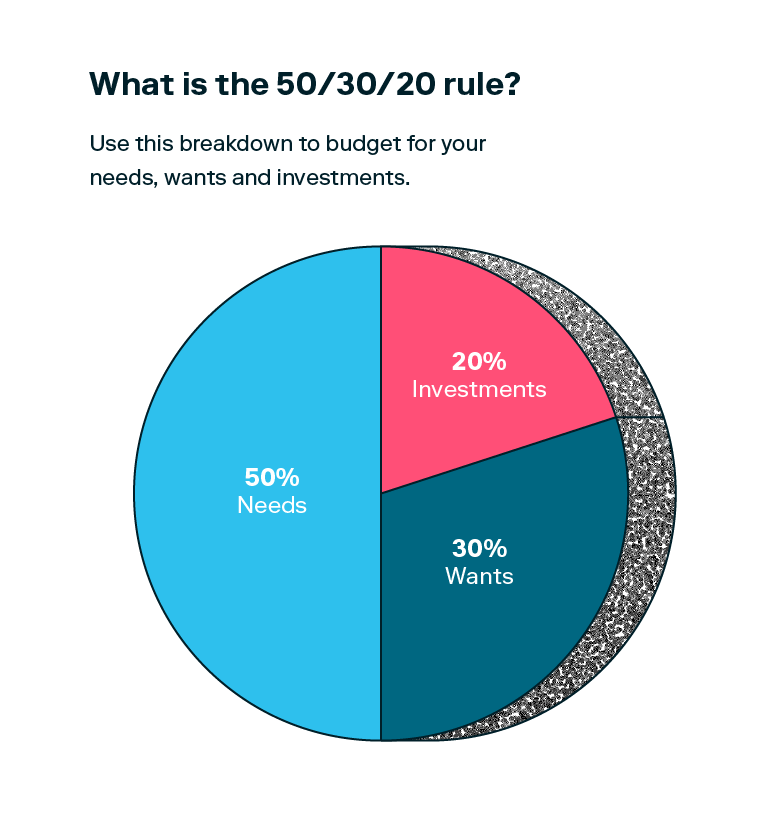

When it comes to determining where your money should go, the 50/30/20 rule is a popular model. You can use it to craft financially sound investing and spending plans.

Here’s how the 50/30/20 rule works:

- Save 50% of your income for your needs, like rent, food, gas, insurance, etc.

- Spend 30% of your income on wants, like date nights and streaming subscriptions.

- Invest 20% of your income into asset classes like the stock market.

So when it comes to how much you should invest, according to this rule, you should aim to invest 20% of your income.

If your income level doesn’t allow for big lump sum contributions to your investment accounts, consider employing a micro-investing strategy. For instance, routinely investing the same amount of money throughout the year—or dollar-cost averaging (DCA)—can help build a strong investment strategy from even the smallest contributions.

If you’re still wondering “how much should I be investing,” the answer remains: as much as you’re comfortable with.

The best practices to help you determine the answer are reviewing your financial situation, investment goals and spending plan regularly.

And remember, when you start your investment journey, you’re not alone—there are financial experts and even robo-advisors to help.

Investing made easy.

Start today with any dollar amount.

How much should I be investing FAQs

Have more questions about how much money you should invest in 2023?” We’ve got the answers.

How much should I invest at my age?

How much you should invest depends less on age and more on income level. However, if you are closer to retirement age and want to save a large sum of money soon, consider investing as soon as possible.

Is it worth investing a small amount?

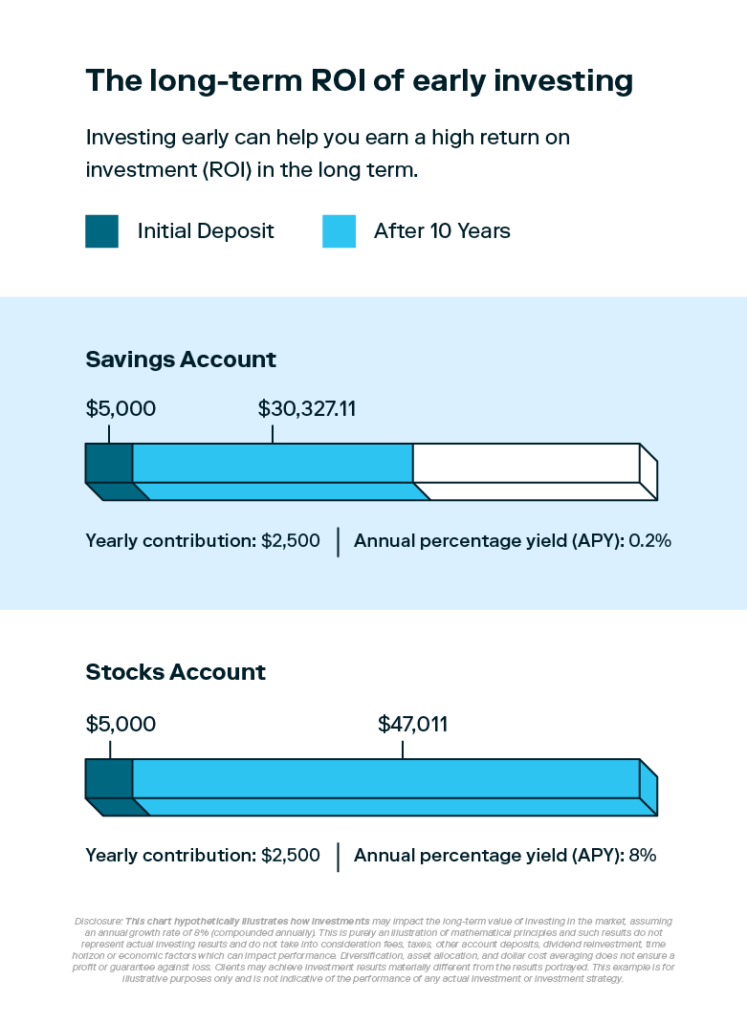

Yes—no amount is too small to begin investing. The sooner you invest, the sooner you can begin earning potential profits from your assets.

What are the advantages of dollar-cost averaging?

When you utilize the dollar-cost averaging method, you become a stable force within a volatile market. This strategy can help you weather turbulent markets and avoid tempting yet risky market trends.

What else can I do to maximize how much I invest?

You can open specialized investing accounts like a traditional IRA or Roth IRA that come with special perks like tax incentives.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement