Jun 2, 2023

17 Best High-Yield Investments for 2023

There’s no denying that investing is one of the best ways to build wealth and accomplish your larger financial goals. But with rising inflation and economists going back and forth on when a recession will happen, many investors are wondering how to choose relatively safe investments with high yield.

What is yield? Investing yield refers to the income that an investor receives as a percentage of the initial amount invested. Yield is calculated by dividing the income earned from the investment by the amount invested. Yield often refers to interest payments from bonds, or stock dividends.

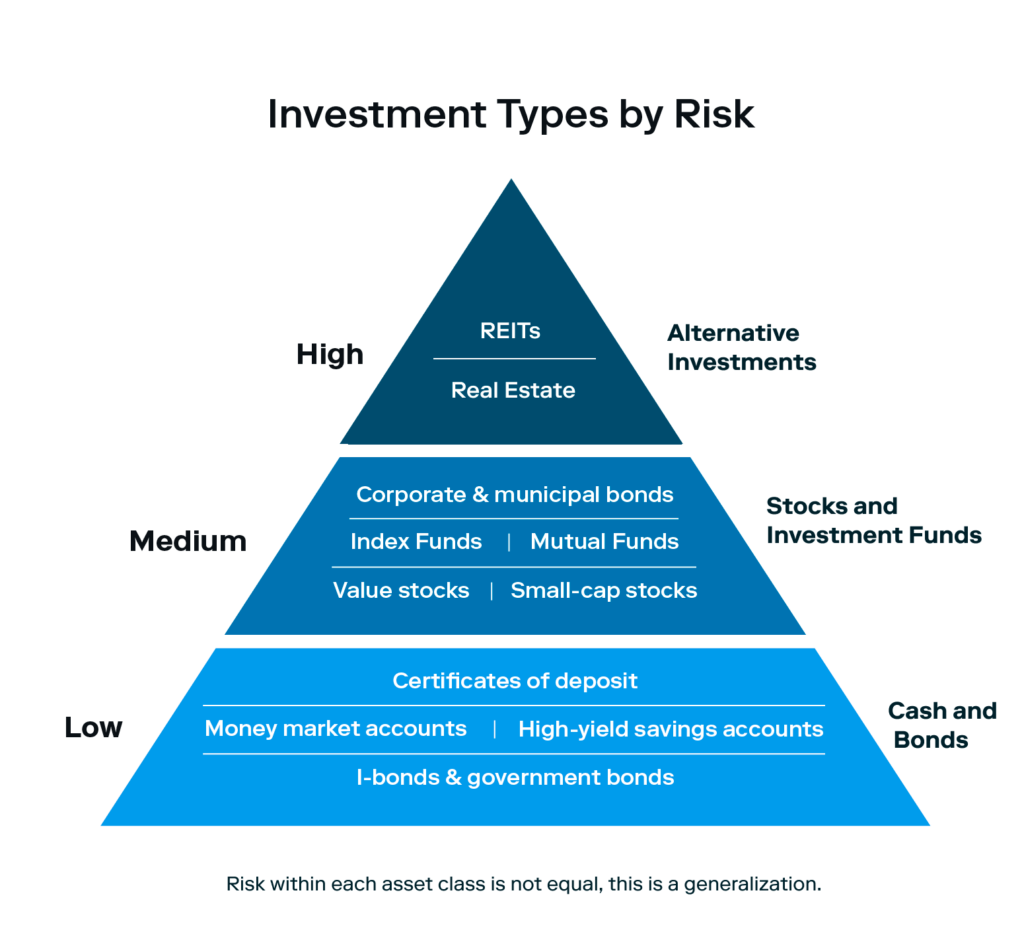

There are countless ways to invest, no matter your age, income, or time horizon—from low-risk investments like money market accounts to higher-risk investment options like stocks or real estate. Every investment comes with different levels of risk, so understanding your personal risk appetite along with the financial goal you have in mind is crucial to creating a portfolio that works in your favor.

No matter what you choose, it’s best to diversify your portfolio with a mix of safe and risky investments.

That’s where our comprehensive guide to high-yield investments comes into play. We’ve analyzed and pared down the 17 best investments right now to consider, grouping them by asset class:

Now, let’s get into it.

Cash and Bonds

While these cash savings accounts and fixed-income securities are very different from one another, they offer low risk ways to accrue higher interest on your idle cash than any traditional savings account could offer you. Investing in fixed-income securities can provide investors with stable income, preservation of capital, and portfolio diversification, but the potential for returns is typically lower than for equities like stocks and other investment funds.

- High-yield savings accounts

- Certificates of deposit

- I Bonds

- Money market accounts

- Government bonds

- Municipal bonds

- Corporate bonds

High-yield savings accounts

Best for: investors with short-term financial goals

Risk: Low

A high yield savings account is similar to a traditional savings account, but it can pay 20–25 times the national average of a standard savings account. As far as safe high-yield investments go, this is certainly one of the safest, since deposits are typically insured by the Federal Deposit Insurance Corporation (FDIC)—meaning in the event of the bank going under, your funds are protected up to $250,000.

High-yield savings accounts also allow you to access cash when you need it, with a limit of six withdrawals per month.

While high-yield savings accounts offer a higher yield than standard savings accounts, they won’t pay enough on their own to meet long-term wealth goals. Instead, they’re best for meeting short-term savings goals like a car or building up an emergency fund.

Certificates of deposit

Best for: risk-averse investors who need money at a specific future date

Risk: Low

A certificate of deposit (CD) is a type of savings account that earns interest on a deposit for a fixed period of time, typically at a higher rate than a standard savings account. CDs are structured by term length, or how long the money must remain in the account before you can withdraw it without penalty. Term lengths can range from a few months to five or 10 years.

CDs are considered a safe investment on the risk spectrum, and deposits are FDIC-insured. That said, your earning potential is bound by the rise and fall of interest rates. Since your money is locked in for the term length, you could miss out on increased earning potential when interest rates rise. In this case, it makes sense to go with a short-term CD so you can reinvest with higher interest rates in the future.

In general, you can earn more with a CD compared to a high-yield savings account, for the trade-off of having your cash locked in for the term length.

Series I bonds

Best for: risk-averse investors who want protection and stability in their portfolio, especially during inflation

Risk: Low

Series I bonds are a low-risk savings product issued by the U.S. Treasury. They earn interest for up to 30 years at a fixed rate and are inflation-adjusted—meaning in addition to the base interest rate, the Treasury also pays an inflation rate twice per year. That additional rate is based on the rate of inflation.

Investors can purchase up to $10,000 of Series I bonds annually, and will earn interest for up to 30 years. If you cash the bond within one to five years, known as early redemption, you’ll have to forfeit the last three months’ interest payments. You can cash the bond after five years penalty-free.

Series I bonds are an attractive option for those who want to invest as safely as possible—along with their ability to hedge against inflation, they’re among the safest investments available.

Money market accounts

Best for: risk-averse investors who need access to cash

Risk: Low

A money market account is another type of federally insured savings account that earns interest. They’re almost identical to a CD or high-yield savings account, except they offer more ways to withdraw money (although you’re still limited to six withdrawals a month).

Money market accounts are best for those seeking a low-risk investment that still offers access to cash when you need it. Like a high-yield savings account, they work well as a short-term savings vehicle for near-term purchases like a car or for building up an emergency fund.

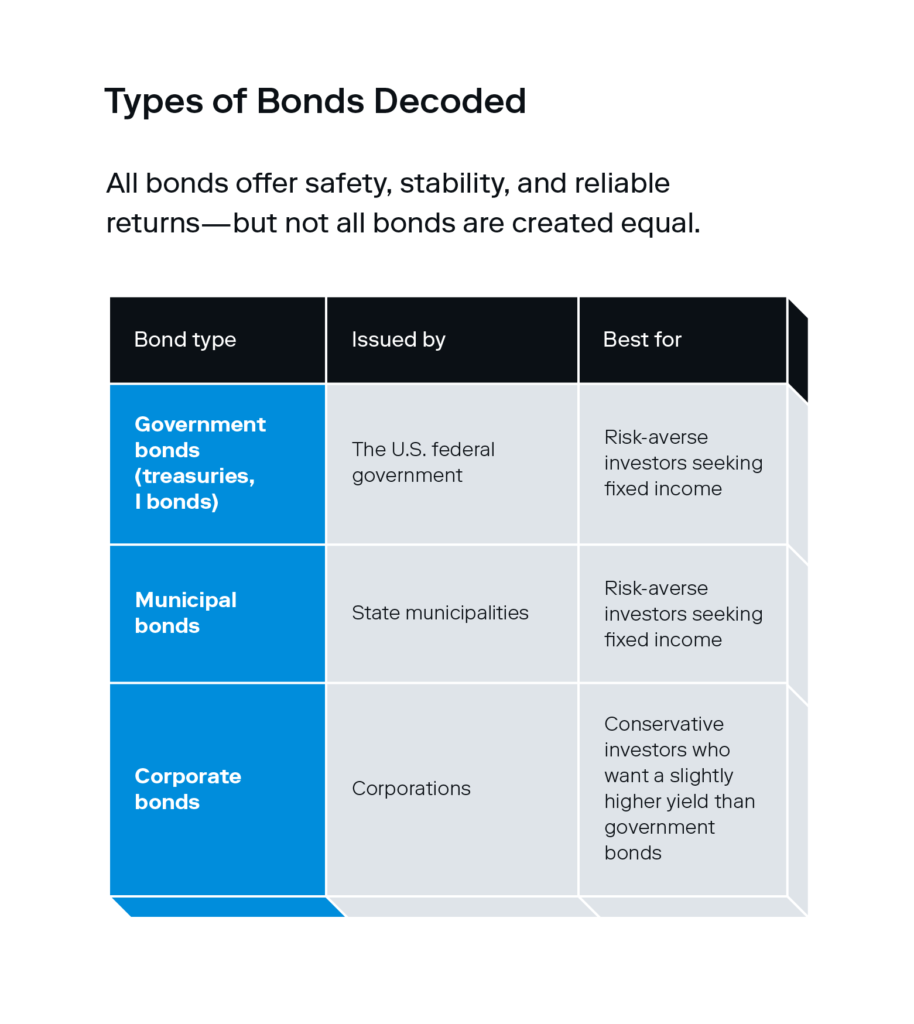

Government bonds

Best for: risk-averse investors seeking fixed income and less volatility in their portfolio

Risk: Low

When you purchase a government bond, you’re essentially loaning the government money, which is used for things like paying off U.S. debt or funding infrastructure spending, for example.. When a bond is issued, the investor is paid a certain amount of interest on an annual basis, making them a fixed-income security. When the bond term ends, the principal amount of the bond is repaid to the investor.

Government bonds are some of the least risky investments out there since they’re backed by the full faith and credit of the U.S. government. In turn, the returns aren’t nearly as high as other investments like stocks. If you’re investing to fund your retirement or long-term wealth goals, government bonds alone likely won’t get you there.

Municipal bonds

Best for: risk-averse investors who want to preserve their portfolio while generating fixed income

Risk: Medium

Municipal bonds, or “munis,” are issued by cities, counties, and other state government entities in order to finance public works projects like building roads or schools. Contrary to corporate or federal government bonds, interest paid on municipal bonds are often tax-free (but not always).

Municipal bonds can be structured in different ways, and there are two main categories:

- General obligation bonds (GOs): these are bonds issued by government entities but not backed by revenue from a specific project. They might be backed by property taxes or from general funds.

- Revenue bonds: these are bonds supported by revenue from a specific project, like a highway or toll road. They repay investors using the income generated by that project.

Revenue bonds usually carry more risk than GOs since the payout depends on the income of a specific project. That said, municipal bonds are still less risky overall than corporate bonds. Like most bonds, municipal bond values rise and fall based on interest rate changes. That means you may suffer losses when interest rates rise. That said, they’re still one of the safer investment vehicles that also come with tax advantages.

Corporate bonds

Best for: conservative investors who want a slightly higher yield than government bonds

Risk: Medium

Corporate bonds are similar to government bonds, except they’re issued by a company instead of a government.

Companies may issue bonds as a way to fund operations, and they fall into two categories:

- Investment grade bonds are typically issued by larger companies with a longer history of dependable earnings, which is why they’re seen as a higher grade investment—there’s less risk because they’re more likely to be repaid.

- Junk bonds are issued by companies who lack a track record of stable profitability. This makes them a higher risk investment, but the returns are typically higher than investment grade bonds.

Overall, corporate bonds are a good option for risk-averse investors looking for a slightly higher return than government bonds. Just keep in mind that unlike government bonds, they aren’t FDIC-insured, so while they’re less risky than stocks, there’s still an added level of risk.

Stocks and Investment Funds

Stocks are ownership shares in a company, while investment funds are portfolios bundling various investments, such as stocks, bonds, and commodities. Both carry the risk of losing value, but they also have the potential for significant returns over the long term. Investing in them can provide a way to grow your wealth and potentially outpace inflation, but it’s important to understand the risks and do your research before investing.

Dividend-paying ETFs

Best for: young investors with small amounts of capital to invest

Risk: Medium

An ETF, or exchange-traded fund, is a basket of stocks that pool in money from investors to buy a collection of securities, which are bought and sold just like individual stocks. They’re well suited for young investors with a long time horizon, and are ideal if you don’t have the time or experience to research individual stocks on your own. Two examples of dividend paying ETFs are the S&P 500 and Nasdaq-100.

ETFs also have a low barrier to entry—you don’t need a huge amount of capital to get started, so if you want to begin investing and earning yield, but don’t know where to start, ETFs are a good option. When you invest in an ETF which includes dividend stocks in its holdings, the ETF also pays a dividend. In fact, there are certain ETFs specifically designed to deliver higher yield, by including stocks that pay above-average dividends. You can get started investing in dividend ETFs on Stash.

ETFs also have the added benefit of easy diversification, since you gain exposure to all the companies in the index your ETF tracks. Just like with S&P 500 index funds or a Nasdaq-100 index fund, if the performance of one company plummets, it can be offset by the high performance of another. Ultimately, the risk of an ETF also depends on its underlying holdings, so make sure you know what they are.

The best high-yield investments ultimately depend on your personal time horizon and risk tolerance. Certain investments are better suited for investors who have decades left before retirement, who can also take on more risk and gain higher returns.

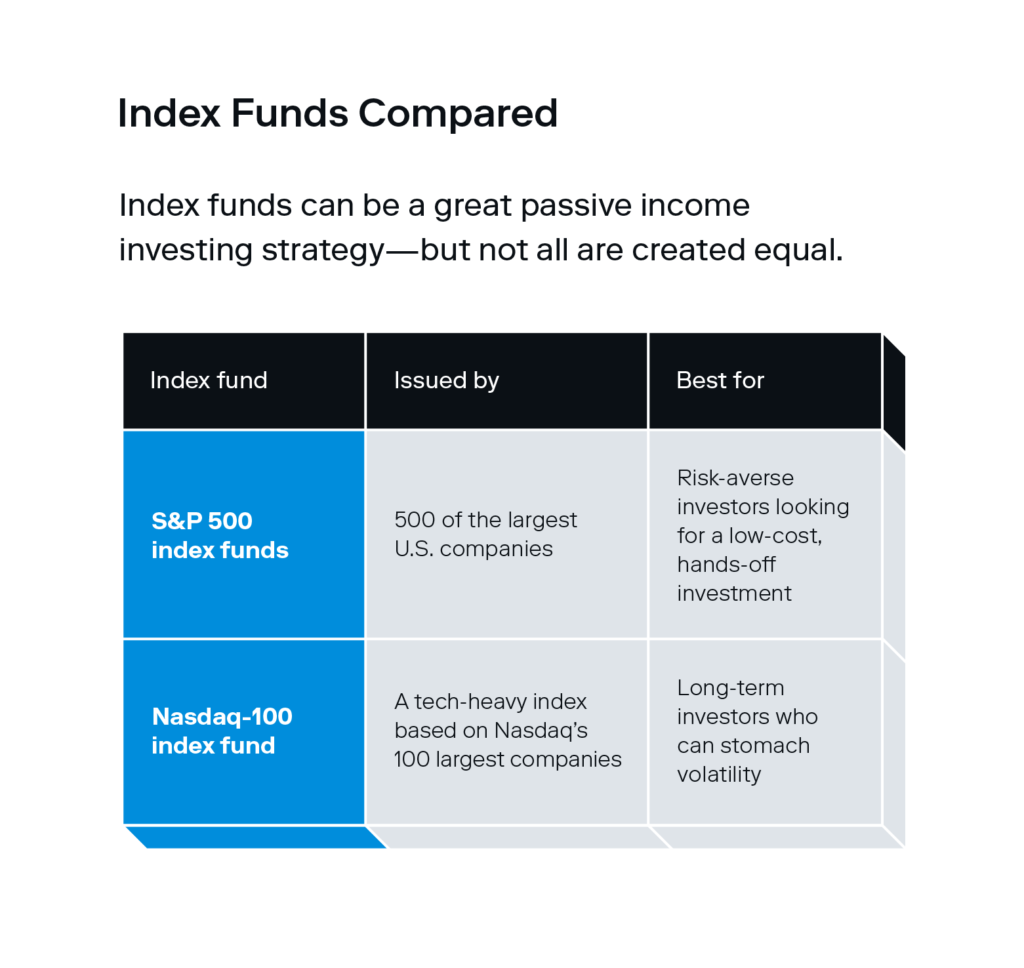

S&P 500 index funds

Best for: investors looking for a low-cost, hands-off investment and stay invested for at least five years

Risk: Medium

Purchasing an S&P 500 index fund means investing in a basket of stocks that follow the S&P 500 index. Index funds are types of ETFs that aim to track the performance of certain stock market indices. In an S&P 500 index fund, the underlying stocks are based on 500 of the largest U.S. companies, such as Apple, Microsoft, and Amazon. The goal of an index fund is to provide returns that mirror the performance of whatever index it tracks, as opposed to an actively managed mutual fund. Many of the stocks in the S&P 500, pay dividends, and therefore, so do the index funds that contain them. Index funds have the benefit of easily diversifying your portfolio, since you’ll own shares in a basket of companies in a variety of industries.

An index fund is an excellent high-yield investment if you have a longer time horizon. While it’s true that stock funds come with more risk than conservative investments like bonds, the S&P 500 index has seen annual returns of 10% on average. And with a longer time horizon, you have plenty of time to weather the ups and downs of the market.

Stash makes it easy to start investing in a low cost, S&P 500 ETF.

Nasdaq-100 index fund

Best for: long-term investors who want broad exposure to the technology sector and can stomach volatility

Risk: Medium

The Nasdaq-100 is a tech-heavy index based on the Nasdaq’s 100 largest companies. It offers exposure to some of the most successful companies of our time, like Apple, Meta (Facebook), and Microsoft. Just like an S&P 500 index fund, a Nasdaq-100 index fund also has the benefit of easy diversification. If the performance of one company is down, it can be offset by the growth of another. Also like the S&P 500 index funds, these ETFs will pay dividends assuming the underlying holdings of the fund pay dividends, generating yield.

If you have a long time horizon, a Nasdaq-100 index fund can be one of the highest-yield investments available. It’s ideal for investors who are willing to handle a decent amount of volatility in exchange for a high growth potential. And if you’re still decades away from retirement, you can ride out the short-term volatility and rest assured that you’ll see positive returns after longer periods of time.

Mutual funds

Best for: investors who want instant diversification without having to research stocks themselves

Risk: Medium

Like index funds, a mutual fund lets you invest in a variety of stocks, bonds, and other securities. The difference between the two lies in their objective: while an index fund seeks to match the returns of a given stock index, a mutual fund aims to outperform the market. Mutual funds are also actively managed by a paid professional, who chooses the stock holdings that make up the fund. This means that mutual funds come with higher fees than index funds, which can cut into potential gains.

Mutual funds can be a strong high-yield investment, but only if you can identify a fund manager with a record of consistently beating the market. In this case, the gains can be huge—but they aren’t guaranteed. Many actively managed mutual funds actually underperform in the market, making them slightly more risky than an index fund. If you choose to pay the extra fees for a mutual fund that doesn’t end up beating the market, you’re losing money.

Money market funds

Best for: conservative investors looking for safe, short-term investments

Risk: Low

A money market fund is a mutual fund that pools money from multiple investors to purchase short-term, low-risk securities. These funds aim to provide stability and preserve capital while offering a slightly higher return than a traditional savings account. They typically invest in government securities, certificates of deposit, and high-quality commercial paper, making them suitable for investors seeking liquidity and minimal risk. This is not to be confused with the money market accounts you read about earlier.

While money market funds provide stability and easy access to funds, the returns are relatively modest compared to riskier investment options, such as stocks or bonds. The primary objective of money market funds is to provide a stable value and consistent income, rather than significant capital appreciation.

Dividend stocks

Best for: long-term investors looking for immediate positive returns or retirees looking for cash flow

Risk: Medium

Dividend stocks offer both the periodic income of bonds and the higher growth potential of stocks. A dividend is a portion of a company’s profits that are paid out to investors, commonly every quarter. While any investor can benefit from dividend stocks, they’re usually favored by investors who need income in the short term but can still stay invested for long periods of time.

While dividend stocks don’t usually grow as quickly as growth stocks, many investors favor them for the stability they provide through regular cash payouts. There are many companies you can buy dividend stocks from, and if you’re buying individual stocks (versus a stock fund), you’ll need to do your research upfront to reduce your risk. Look for companies that have demonstrated consistent growth, not just the one with the current highest yield.

Value stocks

Best for: investors who prefer more stable stock prices

Risk: Medium

Value stocks tend to have low share prices relative to the company’s financial performance. They’re often seen as a bargain on the stock market. You can spot them by comparing a company’s performance to its share price—if a company has a track record of rising sales and profitability, but the share price is relatively cheap, it’s likely a value stock.

While all stocks carry more risk compared to securities like bonds, value stocks tend to be less volatile overall. And contrary to growth stocks—stocks whose earnings grow at a faster rate than the market average—they also tend to perform better during times of inflation and rising interest rates.

Investors who are still a long way from retirement can benefit greatly from value stocks. They’re well suited for those who can stomach more risk than that of bonds, but who still want their investments to lean on the safer side. Many value stocks also pay dividends, making them a good option if you’re looking for a steady cash flow.

Small-cap stocks

Best for: investors who can dedicate time and effort into company research and can handle high volatility

Risk: Medium

Small-cap stocks are stocks from companies with a small market capitalization. These companies usually have less capital and brand awareness than more established companies, but many large-cap companies started out as small-caps. These companies can generally be considered growth stock as they’re often in the early stages of their growth and have the potential for significant expansion. Like larger companies, many small cap stocks pay dividends. Sometimes these dividends can be higher than those of larger companies to offset some of the risk of investing in a smaller, less-proven corporation.

Take Amazon, for example—believe it or not, Amazon started out as a small-cap company. Capitalizing on the high growth potential of small-cap stocks requires a level of foresight—you’re investing in these companies before they balloon in value, and there’s no guarantee that they will.

Successful small-cap investing requires thorough research of the company upfront, and the ability to handle a high amount of risk. Small-cap stocks are more vulnerable to price volatility due to their size, so large fluctuations in price movements should be expected. That said, if you do invest in a small-cap company that successfully scales their business and achieves their potential for growth, it can be highly lucrative.

If you want exposure to small-cap stocks without having to do intensive research, you can also invest in them through ETFs and mutual funds—browse Stash’s list of curated ETFs for an easy way to invest towards your goals.

Alternative investments

Alternative investments are non-traditional assets, such as hedge funds, private equity, real estate, and commodities, that are not publicly traded on any stock exchange. These investments have the potential for higher returns than traditional investments, but with high rewards comes high risk. Often, these alternative investments lack liquidity, transparency, and regulation, and may have complex fee structures. The potential for loss in capital invested is very real so these types of investments are best suited for investors with an appetite for high-risk.

Real estate investment trusts (REITs)

Best for: investors who want to invest in real estate without actually managing a property themselves

Risk: High

If you want a more hands-off way to capitalize on real estate without putting in the effort required to manage a property, one way is to buy shares of real estate investment trusts, or REITs. A REIT can own a variety of properties, from apartment complexes and shopping centers to residential properties, and they use funds from investors to manage them.

The revenue generated from REITs can be used to pay dividends to investors, which often deliver above-average returns—90% of the income generated is required by law to be funneled back to investors. As far as high-yield safe investments go, REITs are an attractive option.

Real estate

Best for: investors who wish to manage a property

Risk: High

If you’re looking for decently safe investments with high returns, consider real estate. If managed properly, it may yield higher-than-average returns and provide stable value in the long term. That said, real estate still comes with its own set of risks, and there are never any guarantees.

One benefit of real estate investing is that it’s more likely to retain its value when inflation is high—sometimes even increasing. Property values can also naturally appreciate over time, but they aren’t immune to severe market conditions. Many investors favor capitalizing on property investments as a way to earn passive income.

Keep in mind that real estate investing requires a significant amount of work and money upfront, and it’s highly illiquid—meaning you shouldn’t invest with money you might need easy access to in the future.

While the potential for rewards are high, it’s not uncommon for real estate to see lower returns overall than the stock market. In general, real estate investing is best for investors who already have a healthy investment portfolio and are willing to put in the effort to yield higher returns.

Investing made easy.

Start today with any dollar amount.

FAQs about high-yield investments

Find answers to any lingering high-yield investing questions below.

Which investment gives the highest return in the short term?

Dividend stocks offer regular cash payouts to investors, making them a good option if you’re looking for immediate positive returns. If you reinvest those dividends over time, you can also utilize compounding to yield higher returns.

What is the safest high-yield investment?

Treasury bonds and Series I bonds are among the safest investments around since they’re backed by the full faith and credit of the federal government. That said, the returns aren’t as substantial as what you’d see from investing in the stock market.

What is the safest investment with the highest return?

Generally, investments that are considered safer tend to offer lower returns, while investments with higher potential returns often come with increased risk. Some investments typically considered safer include government bonds, high-quality corporate bonds, and certificates of deposit (CDs). These investments provide a fixed income stream and are backed by reputable institutions.

Related Articles

The 12 Largest Cannabis Companies in 2024

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How To Invest in the S&P 500: A Beginner’s Guide for 2024

Stock Market Holidays 2024

The 2024 Financial Checklist: A Guide to a Confident New Year

How To Plan for Retirement