Mar 10, 2023

10 Best Debit Card Rewards Programs for 2023

Whether you’re an avid online shopper or hate carrying cash, a debit card is a helpful tool for spending your money, and a great alternative for those who don’t want a credit card.

Many credit cards are known for their fancy rewards programs, and your plain jane debit card may make you feel left out.

Don’t worry, as there are also debit cards with reward programs that you can use to earn cash back, points, or investments for your future, all on your regular spending.

So get ready, as we’ve gathered the 10 best debit card rewards programs in 2023 in no particular order, including:

- Discover Cash Back Debit Card

- Axos Bank Cash Back Checking Debit Card

- Extra Rewards + Credit Building Debit Card

- Ando Visa Debit Card

- Bank of America Advantage Plus Banking Debit Card

- Serve American Express Cash Back Prepaid Debit Card

- Upgrade Rewards Checking Debit Card

- Truist Delta SkyMiles Debit Card

- Aspiration Spend and Save Debit Card

- Stash Stock-Back® Card

Read along to learn more about the best reward debit cards, from cash back to airline miles.

Shop like an investor.

Earn stock every time you swipe with our Stock-Back® Card.

Discover Cash Back Debit Card

Best for: Cash back with zero fees

| Rewards: | Earn 1% cash back on up to $3,000 in purchases each month |

| Fees: | $0 |

| Minimum balance: | $0 |

| Minimum deposit to open: | $0 |

| Mobile check deposit: | Yes |

With the Discover Cash Back Debit Card, you can earn credit card-like rewards, all without needing to meet a minimum balance or pay any fees. With 1% cash back on up to $3,000 worth of purchases, you can earn up to $30 a month on regular spending.

When you choose this debit card with cash back, you’ll get access to their mobile-first banking experience, providing you with mobile check deposit, fraud protection, overdraft fee protection, and early payday, which allows you to get your paycheck up to two days early when you enroll in direct deposit.

To get the card, you’ll need to open a checking account with Discover. In addition to your cash back rewards, this card will give you access to over 60,000 no-fee ATMs in the U.S.

| Pros | Cons |

|---|---|

| 1% cash back on every purchase | Lacks a physical branch |

| Zero monthly fees | No way to directly deposit cash |

| No minimums required | |

| Access to over 60,000 no-fee ATMs |

Axos Bank Cash Back Checking Debit Card

Best for: Cash back and frequent ATM use

| Rewards: | 1% cash back on all signature-based purchases on up to $2,000 worth of purchases |

| Fees: | $0 |

| Minimum balance: | $0 |

| Minimum deposit to open: | $50 |

| Mobile check deposit: | Yes |

The Axos Bank Cash Back Checking Debit Card is another no-fee debit card with rewards. With this Axos card, you’ll get 1% cash back on up to $2,000 worth of spending each month.

But, unlike the Discover card, only purchases that require your signature are eligible for rewards. Because of this, purchases made at grocery stores, super stores, and markets aren’t eligible for 1% cash back.

Additionally, you must maintain an average daily balance of $1,500 to receive the 1% cash back rewards. If you maintain a lower balance, you’ll only be eligible for 0.5% cash back.

| Pros | Cons |

|---|---|

| 1% cash back on signature-based purchases | Non-interest bearing account |

| Unlimited domestic ATM fee reimbursement | Must maintain an average daily balance of $1,500 to get 1% cash back |

| Zero monthly fees | Must deposit $50 to sign up |

| Includes Bill Pay automation features | Many purchases are restricted from earning rewards |

Extra Rewards + Credit Building Debit Card

Best for: Building credit

| Rewards: | Earn up to 1% in points for everyday purchases |

| Fees: | $25 a month or $199 a year |

| Minimum balance: | $0 |

| Minimum deposit to open: | $0 |

| Mobile check deposit: | N/A |

The Extra Rewards + Credit Building Debit Card is the first debit card that allows you to build your credit with everyday purchases. Unlike other debit cards, the Extra card connects to your existing bank account.

Whenever you swipe your Extra debit card, Extra will spot the money and then automatically cover it the next day using your connected bank account. At the end of every month, Extra will report your transactions to credit bureaus, similar to how a credit card provider would.

This allows you to build credit without having to sign up for a credit card or pass a credit check, making it perfect for those with poor credit or no credit history.

In addition to its credit-building features, the Extra Rewards + Credit Building Debit Card earns you up to 1% in points for everyday purchases. With these rewards points, you can redeem them for products and benefits on their rewards store, such as Apple AirPods.

| Pros | Cons |

|---|---|

| Helps build credit | Costly membership fees |

| Earns rewards points with everyday purchases | Only reports to Equifax and Experian (not TransUnion) |

| No credit check required | Not compatible with every bank |

Ando Visa Debit Card

Best for: Environmentally conscious spending

| Rewards: | Earn 1.5% cash back on all eligible rounded-up transactions |

| Fees: | $0 |

| Minimum balance: | $0 |

| Minimum deposit to open: | $0 |

| Mobile check deposit: | Yes |

If you’re environmentally conscious and want to bank with a company that cares about fighting climate change, then the Ando Visa Debit Card may be the right debit card for you.

When you enroll in their Change that Counts program, every time you swipe your card, Ando will round up your purchase to the nearest dollar, and Ando will donate the spare change to projects that work to help save the environment.

For example, if you buy a coffee for $5.75, you’ll pay $6.00, and the added $0.25 will go toward helping plant trees or fund other environmental causes.

Not only that, but every rounded-up transaction helps you earn unlimited 1.5% cash back, helping you save the planet and your wallet, making this one of the coolest debit cards on our list.

| Pros | Cons |

|---|---|

| 1.5% cash back on rounded up transactions | Cash back only works on rounded up transactions |

| Every purchase helps fight climate change | Out of network ATM fees are not reimbursed |

| Zero monthly fees | No physical locations |

Bank of America Advantage Plus Banking Debit Card

Best for: Store-specific cash back

| Rewards: | Up to 15% cash back from select merchants |

| Fees: | $12 a month |

| Minimum balance: | $0 |

| Minimum deposit to open: | $100 |

| Mobile check deposit: | Yes |

While a typical Bank of America debit card may not seem flashy at first, it is actually one of the best debit cards with rewards. By signing up for a Bank of America Advantage Plus Banking Debit Card, you’ll have access to BankAmeriDeals, which allows you to browse and activate cash back deals for spending at your favorite restaurants, stores, and more.

After selecting the deals you want, you’ll receive cash back to your account 30 days after your eligible purchase. On top of that, every time you redeem a BankAmeriDeals offer, you’ll receive a “Coin.”

If you earn 4 “Coins” within 60 days, you will earn a $5 cash reward that will be deposited into your Bank of America checking account.

In addition, you may also be able to waive your monthly fee by meeting one of the following requirements during each statement period:

- Have at least one qualifying direct deposit of $250 or more

- Be enrolled in Bank of America’s Preferred Rewards program

- Maintain a daily balance of at least $1,500

| Pros | Cons |

|---|---|

| Up to 15% cash back | Cash back is limited to select merchants |

| Monthly fees may be waived if certain criteria is met | $100 deposit is needed to open an Advantage Plus Banking account |

| BankAmeriDeal “Coins” provide an added cash back bonus | BankAmeriDeal offers must be manually selected and activated |

Serve American Express Cash Back Prepaid Debit Card

Best for: Prepaid card users

| Rewards: | Unlimited 1% cash back on eligible purchases |

| Fees: | $7.95 a month + up to $3.95 for each cash reload |

| Minimum balance: | $0 |

| Minimum deposit to open: | $20 |

| Mobile check deposit: | Yes |

The Serve American Express Cash Back Prepaid Debit Card is a great option for those looking for the perks of a rewards debit card without having to sign up for a checking account. Unlike the other options on this list, this Serve card is entirely prepaid.

This means you can reload the card with cash in stores or transfer money from an existing checking or savings account.

Also, this prepaid debit rewards card gives you access to American Express Card Membership Benefits and Services, including Roadside Assistance and exclusive Amex Offers at your favorite businesses, including stores, restaurants, and more.

| Pros | Cons |

|---|---|

| Cash back can be quickly redeemed for a future purchase | Costly cash reload and monthly fees |

| Access to Amex Card Membership Benefits and Services | Lacks a checking account |

| Free withdrawals at MoneyPass ATMs |

Upgrade Rewards Checking Debit Card

Best for: Everyday cash back

| Rewards: | Up to 2% cash back on eligible purchases |

| Fees: | $0 |

| Minimum balance: | $0 |

| Minimum deposit to open: | $0 |

| Mobile check deposit: | Yes |

The Upgrade Rewards Checking Debit Card is one of the best cash back debit cards available. With this card, you’ll earn 2% cash back (up to $500 per calendar year) on everyday expenses at merchants such as gas stations, restaurants, drug stores, utility companies, and more.

In addition, any transaction that doesn’t fall into one of these categories will still earn 1% cash back, making this one of the best no-fee cash back debit cards available. On top of that, you’ll continue earning 1% cash back even after you’ve hit your $500 limit on 2% cash back.

| Pros | Cons |

|---|---|

| Cash back on every purchase | Cash deposits aren’t accepted |

| No monthly fees | Only five ATM fee reimbursements per month |

| 2% cash back capped at $500 per year |

Truist Delta SkyMiles Debit Card

Best for: Travel

| Rewards: | Earn 1 mile for every $2 spent |

| Fees: | $95 a year |

| Minimum balance: | $0 |

| Minimum deposit to open: | $50 |

| Mobile check deposit: | Yes |

If you love to travel, then the Truist Delta SkyMiles Debit Card is a good debit card for you. With this Truist card, you’ll earn 1 mile for every $2 you spend and additional miles on direct purchases from Delta, including tickets and in-flight purchases.

You can redeem these miles for Award Travel, Delta Sky Club memberships, Delta Vacation Packages, and more, making this the best debit card for travelers. Plus, Delta SkyMiles never expire, enabling you to save your miles for the summer vacation of your dreams.

| Pros | Cons |

|---|---|

| Earn miles on every purchase | Costly annual fee |

| Miles never expire | $50 minimum deposit required to open a Truist One checking account |

| Miles can be redeemed for Award Travel, Delta Vacation Packages, and more |

Aspiration Spend and Save Debit Card

Best for: Eco-friendly shoppers

| Rewards: | Up to 10% cash back on Conscience Coalition purchases |

| Fees: | $0 for Aspiration or $7.99 for Aspiration Plus |

| Minimum balance: | $0 |

| Minimum deposit to open: | $10 |

| Mobile check deposit: | Yes |

The Aspiration Spend and Save Debit Card is another eco-friendly option for those who want to get cash back while also supporting a company that is working to turn the tide on climate change. Not only is your debit card made from recycled plastic, but Aspiration pledges to donate 10% of its profits to charity and sustainable initiatives.

When you use the Aspiration Spend and Save Debit Card, you’ll also be rewarded for shopping with companies that care about the environment, earning up to 10% (up to 3-5% for free members) cash back on purchases made at Conscience Coalition businesses. Examples of Conscience Coalition businesses include Tony’s Chocolonely, Dropps, and Cloud Paper.

If you’d like to spend even greener, you can round up every purchase to help plant a tree every time you swipe your card, making this a unique choice compared to most other debit cards with cash back.

| Pros | Cons |

|---|---|

| Up to 10% cash back on Conscience Coalition purchases | Cash back is limited to specific businesses |

| Help plant a tree with every purchase | Aspiration Plus can be costly |

| Free network of 55,000 ATMs |

Stash Stock-Back® Card

Best for: Investors

| Rewards: | Up to 3% Stock-Back®³ |

| Fees: | $0 |

| Minimum balance: | $0 |

| Minimum deposit to open: | $1 |

| Mobile check deposit: | Yes |

The Stash Stock-Back® Card1 is the only debit card that invests in you every time you spend. Unlike a debit card that gives cash back, the Stock-Back® Card gives you rewards in the form of fractional shares of stock.

For example, if you buy something from Starbucks, you’ll be rewarded with SBUX Stock-Back® as a reward. If the company you’re shopping with isn’t available as an investment on our platform, you’ll instead earn Stock-Back® in your reward of choice.

With the Stock-Back® card, you can earn up to 3% in Stock-Back® rewards3 that can grow over time, making this the perfect debit card for building wealth rather than accumulating debt.

On top of that, you can increase your investing power with Stock Round-Ups, which automatically rounds up each of your purchases to the nearest dollar and invests the spare change in your Stash account.

To start saving and building wealth with the Stock-Back® card, you can sign up for one of our monthly plans costing between $3 and $9 per month. Our subscription-based platform offers a variety of tools for investing, banking, and saving, including personalized advice and the option for an automated investing portfolio.

| Pros | Cons |

|---|---|

| Invest in your future with every transaction | No cash back |

| No add-on commission fees | |

| Access to thousands of fee-free ATMs⁴ | |

| Stock Round-Ups | |

| Early direct deposit² |

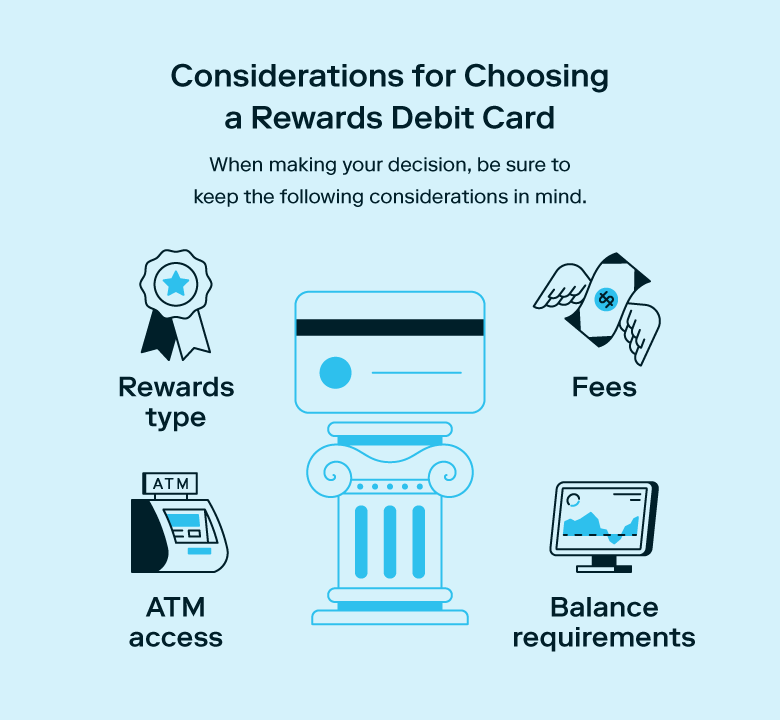

Things to consider when choosing debit card rewards

With the top debit cards with rewards in mind, it’s time to pick the one that fits your spending and rewards needs. While looking for the best debit card to get, keep the following factors in mind:

- Rewards type: When choosing a debit card with rewards, you’ll want to choose a card with perks that will benefit you the most. For example, if you love to travel, you may want to select a debit card that rewards you with travel miles.

- Fees: While some debit cards may be fee-free, others may include monthly maintenance fees, overdraft fees, or other additional costs. Before deciding on a debit card, always do your research to ensure you avoid surprise fees.

- ATM access: If being able to withdraw cash at ATMs is a priority for you, you may want to prioritize a debit card that has ATM fee reimbursement or free ATM use in your area.

- Balance requirements: Before getting your heart set on a specific debit card rewards program, check and see if you meet the minimum balance or deposit required to open the account. Depending on the card, this can range from zero to hundreds of dollars.

Now that you know the best debit card rewards for 2023, you can level up what’s in your physical or digital wallet and get rewarded while you shop.

FAQs about debit card rewards

Still scratching your head with questions about debit card rewards? We got you covered.

Which banks give reward points on debit cards?

Some banks and financial service companies that offer rewards debit cards include Discover, Axos, Ando, Bank of America, American Express, Upgrade, Truist, Aspiration, and Stash.

How do you earn points on your debit card?

While the specifics can vary from card to card, most debit cards allow you to earn points based on your spending. In some cases, you may earn a certain number of points for every dollar spent.

Other times, you may have to spend money at a specific type of store (grocery stores, restaurants, etc.) to earn debit card points, and not every transaction may be eligible.

What are cash back debit cards?

Cash back debit cards are debit cards that allow you to earn a certain percentage of cash back on every eligible purchase.

Are cash back debit cards worth it?

In short, it depends. If you frequently use a debit card and feel that the cash back will outweigh any monthly or annual fees, then a cash back debit card may be worth it. If you rarely use a debit card, it may not be worth the fees that some cash back debit cards have. Fortunately, some of the debit cards on our list have zero fees.

Which debit card gives the most cash back?

Of the cards featured on our best debit card rewards list, the Upgrade Rewards Checking Debit Card offers the most cash back, with up to $500 in cash back on eligible 2% cash back purchases and unlimited cash back on eligible 1% cash back purchases.

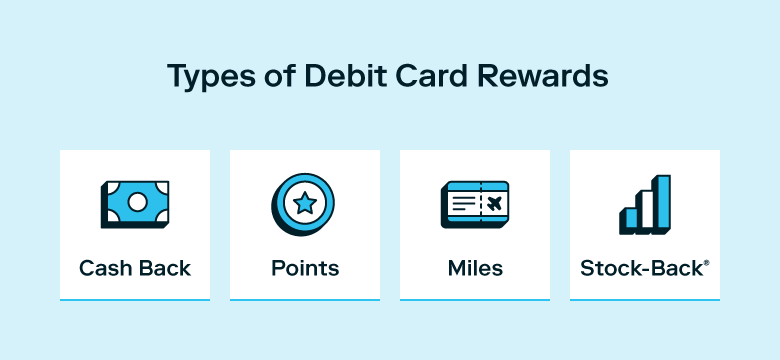

What are the different types of debit card rewards?

Similar to credit card rewards, debit card rewards can vary depending on the card. Some common types of debit card rewards include:

- Cash back

- Points

- Travel miles

What store gives the most cash back on debit cards?

When you use a cash back debit card, the rewards are given to you by the card issuer rather than the store itself. If you shop at a specific store more than others, look for a debit card that offers a higher amount of cash back for specific purchases, such as transactions at grocery stores.

Which debit card is best for rewards?

Most debit cards offer specific rewards that can vary from card to card. Because of this, no debit card offers the best rewards for everyone. When choosing a rewards debit card, keep your spending habits and needs in mind.

Investment products and services provided by Stash Investments LLC, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. Ancillary fees charged by Stash and/or its custodian are not included in the subscription fee.

1 Stash Banking services provided by Stride Bank, N.A., Member FDIC. The Stash Stock-Back® Debit Mastercard® is issued by Stride Bank pursuant to license from Mastercard International. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Any earned stock rewards will be held in your Stash Invest account. Investment products and services provided by Stash Investments LLC, not Stride Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. In order for a user to be eligible for a Stash banking account, they must also have opened a taxable brokerage account on Stash.

All rewards earned through use of the Stash Stock-Back® Debit Mastercard® will be fulfilled by Stash Investments LLC and are subject to Terms and Conditions. You will bear the standard fees and expenses reflected in the pricing of the investments that you earn, plus fees for various ancillary services charged by Stash. In order to earn stock in the program, the Stash Stock-Back® Debit Mastercard must be used to make a qualifying purchase. Stock rewards that are paid to participating customers via the Stash Stock Back program, are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. What doesn’t count: Cash withdrawals, money orders, prepaid cards, and P2P payment. If you make a qualifying purchase at a merchant that is not publicly traded or otherwise available on Stash, you will receive a stock reward in an ETF or other investment of your choice from a list of companies available on Stash. See Terms and Conditions for more details.

2 Early access to direct deposit funds depends on when the payor sends the payment file. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

3 Limitations apply; 3% Stock-Back rewards available only for qualified bonus merchants on Stash+.

4 Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

Related Articles

Saving vs. Investing: 2 Ways to Reach Your Financial Goals

How to Save Money: 45 Best Ways to Grow Your Savings

How to Set Up an Emergency Fund

How Much of Your Paycheck Should You Save?

How To Stop Impulse Buying

29 Side Hustles To Consider in 2024